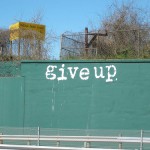

I’ve been thinking a lot lately about difficult situations. When is enough enough? How do you know when you should just focus your energy elsewhere? Sometimes life can really make you feel like you are beating your head against a brick wall. A lot of the articles on Enemy of Debt talk about persevering. However, there may be times when it is a smarter financial move to just give up. Here are some financial examples of when you might want to say, “Enough!” Making payments on something that isn’t worth it This could be a house, car, or something else. […] Read more »