Are you looking to save your children from making the same financial mistakes you have?

Are you looking to save your children from making the same financial mistakes you have?

I think most parents would say YES without hesitation but don’t really know where to start. That used to be me but one thing I realized is that the more I learned about improving my own financial situation the easier teaching my children about money became.

Another problem parents have is that they consider money a taboo subject. Some parents do not wish to share their own personal experience with money with their kids. Perhaps, it’s because they don’t want to give their kids information that could be used against them in a fight or maybe they just don’t feel it’s anyone’s business.

I feel it is in our best interest as parents to share our financial struggles with our children. The more they see and hear from you, the more they’ll understand why good money management is essential to their own success. If you don’t share your experiences — the good and the bad — what other example do they have to learn from?

Everyone else around them!

With 6 out of every 10 people living paycheck to paycheck what will they see? They will see debt as a “tool”, they won’t learn about saving and investing and why they’re important, and they certainly won’t learn how to manage their money.

They’ll do what they think is normal. I like what Dave Ramsey says. NORMAL IS BROKE!

Help them avoid broke.

Make Time for Conversation(s) About Money

Let them attend the weekly/monthly budget meetings.

Teach them about compound interest.

Share with them the struggle you’ve had (or are having) to become debt free. Show them what you can’t do because your debt payments are squeezing your paychecks dry.

It’s okay to admit you’ve made mistakes financially. In fact, your kids will thank you for preparing them for success by showing them what works and what doesn’t.

Sometimes it’s as simple as just discussing what you’re doing at the moment.

Kid: “Where are we going daddy?”

Parent: “We’re going to the bank.”

Kid: “What’s a bank?”

Parent: “Where we keep our money so we can pay the bills.”

Kid: “What are bills?”

Parent: “Bills are things we pay to have a roof over our head, lights on when it’s dark, and heat when it’s cold. We also keep money in the bank so we can put gas in the car to take you to baseball practice, and buy food so you grow big and strong.”

If you have kids you probably know that conversation could go on forever.

I try to make my answers relate to them so they can personalize the answers. I can tell you the conversation above has happened and I likely went on to talk about where money comes from and how we earn it. A lot of kids think the bank will just give you money. My oldest son has informed us a few times before that the solution was to go to the bank to get some more money. He doesn’t say that anymore because he now knows we have to earn the money before the bank can hold it for us. 🙂

I’ve heard parents move right past a comment like that without taking the golden opportunity to explain a few details and fill in the blanks on the fly. It’s opportunities like that that I just love having. The important thing is to be age appropriate with your response and if you have really young kids keep it brief. The longer you ramble the quicker you’ll lose their interest and they’ll move on.

Communication can be a great way to educate your children as well as bond with them in the process.

Let Them Experience Earning Money for Themselves

Give them a few chores to do to earn a weekly commission.

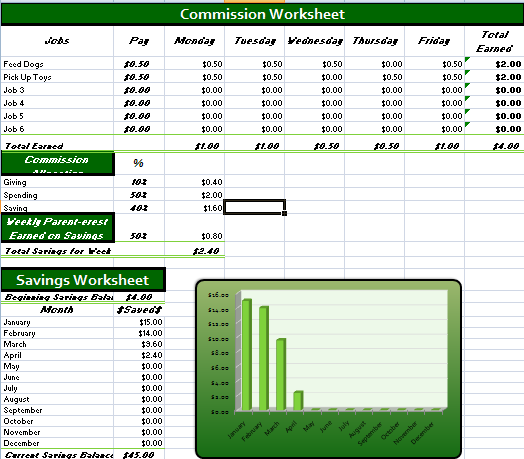

Check out this form I created for parents to keep track of their kids commissions.

Microsoft Excel 2003 – Kids Finance 101

Microsoft Excel 2007 – Kids Finance 101

Our 5 year old has two chores that he gets paid for each week. He has other chores that are done without being paid simply because he’s a part of the family and should help out but we thought giving him the opportunity to see how money is earned would be very beneficial.

When he does his chores he gets paid. When he doesn’t do his chores he doesn’t get paid. It’s that simple.

Once he gets paid we go through the process of dividing his money into 3 parts – Saving, Spending, and Giving.

Again, it’s important to keep it age appropriate. Be as creative as you want to in order to make it fun.

Kids 7-12 could learn about taxes. So when it came time to split up the money there would then be 4 categories. Maybe I would hold onto the money my kids paid me in taxes and use it to give it back to them in the form of compound interest over time. Two lessons in one. What a fun way to teach them about something that could be very boring?

For teens you could add yet another category for Necessities to teach them about what it means to work and pay bills. That money collected could go towards their first car by doing what Dave Ramsey did with his kids. He called it the 401Dave. His kids saved money for their first car and he matched whatever they saved. I would take the money they paid me for “bills” and use it to do a match. What better way to encourage your teens to save than by matching their efforts.

Those are just a few of the things we’ll likely try in order to continue our kids financial education at each stage of their life.

The most important thing you can do for them is to be the example. Avoid the saying “Do as I say, not as I do.” How you manage your money will likely be how your kids manage theirs. Your example and purposeful communication mixed with a little hands-on experience will go along way in helping them reach their financial goals in life.

I talk to my 5 year old constantly about money and debt. Here is a fun video we made for Financial Literacy Month 2012 to hopefully encourage parents to start the conversation with their children.